Who do you think the above quote came from?

If you said me, you are wrong.

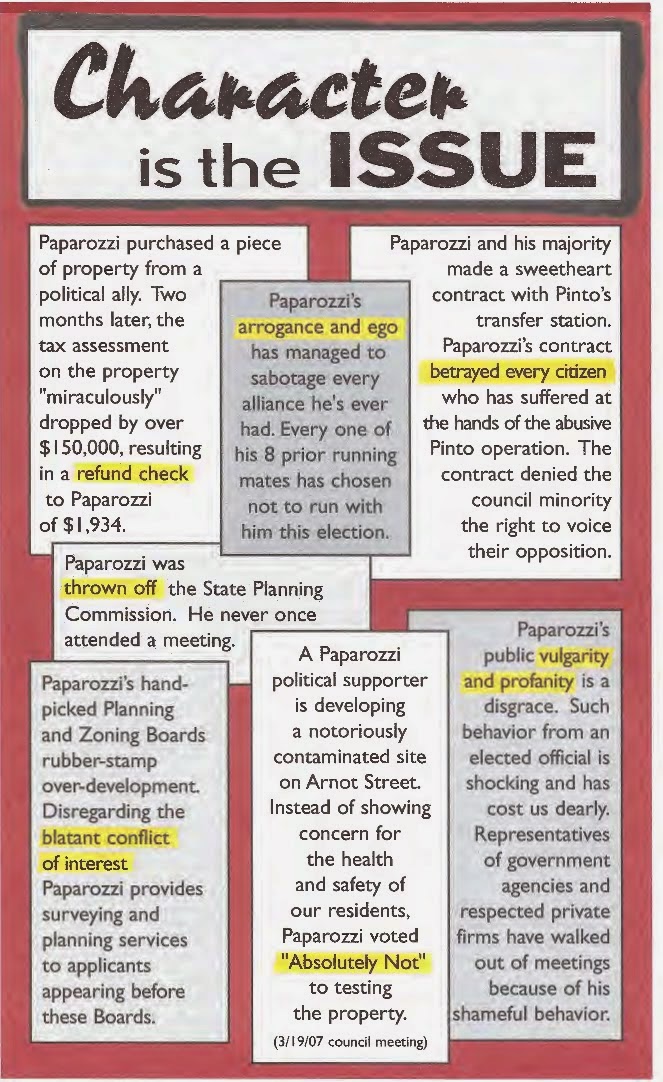

In 2007, Gary Paparozzi was Lodi’s mayor. Currently, he is a borough employee with the

title “Technical Inspector”. Separate

from being on the borough payroll, he also appears on the borough’s monthly

bills for the NO BID contract he received for “Planning”.

Gary Paparozzi purchased house on Bell Ave in 2005

for $440,000. Shortly after, his

assessment dropped to $321,000. He sold

the house in 2009 for $415,000.

The numbers

speak for themselves. The reduction for a

then sitting mayor cannot be justified.

In 2014 alone, the property taxes on the property were $4,438 less due to the Paparozzi reduction.

Today’s estimate from Zillow is $433,210, which is

$111,810 above the assessed value.

But if you aren’t a member of the “family and friends”

plan, and you enter your address on Zillow, it likely will show that you are

over assessed. How can there be such a disparity?

The Lodi politicians made strong accusations against

Paparozzi during that campaign. You would think that this administration would investigate the tax

reductions for “family and friends”. You

would think that there would be some form of transparency and accountability

from the assessor’s office.

Unfortunately,

even more tax reductions for “family and friends” took place after the 2007

election. This administration even used

their Borough Attorney to fight the “in house reductions” from

being released.

But there is no question that these special favors

have taken place. I exposed the tax

assessor’s actions at a public council meeting with him in attendance. What the tax assessor said at that meeting

was so damaging to this administration, this is what was left on the minutes:

“(Due to individuals not speaking into the microphone, Borough Clerk was

unable to get more of the conversation. Borough Clerk is going to recommend

individuals speak directly into the microphone when speaking.)”

The microphone worked for

the rest of that meeting. Minutes are

posted on the borough website dating back to 2008. The microphone worked for those

meetings. But the microphone didn’t work

when the “in house reductions” were questioned.

Your last name shouldn’t

determine what you pay in property taxes.